Global Refractory Industry Outlook for 2026-27

Table of Contents

Introduction

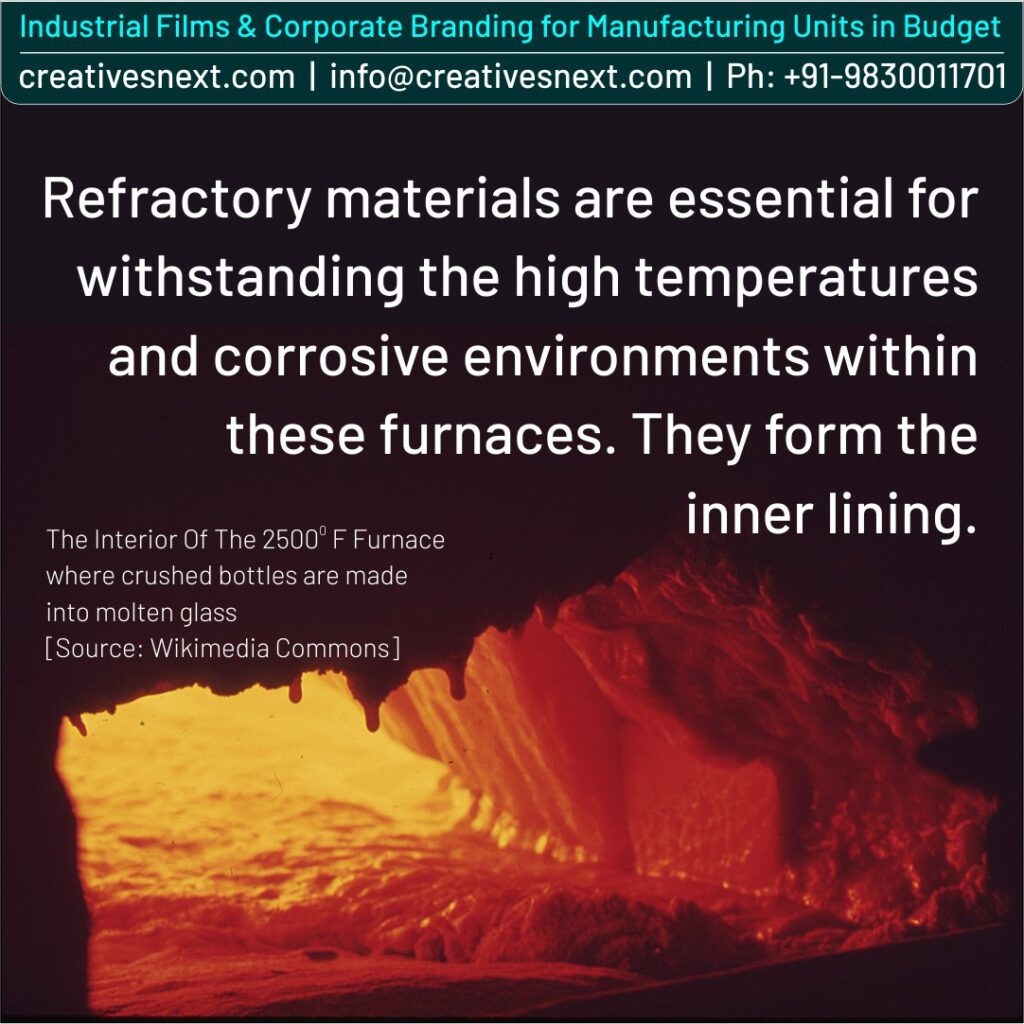

The refractory industry, often described as the “unsung hero” of modern industrial civilization, is at a critical inflection point.

These non-metallic materials, capable of withstanding extreme temperatures exceeding 1,000°C, form the essential linchpin of every high-temperature process, from the fiery heart of a steel furnace to the glowing kilns of a cement plant.

As the global economy navigates post-pandemic recovery, geopolitical tensions, and the urgent imperative of decarbonization, the refractory sector is undergoing a profound transformation.

In this piece, we’ll delve into the current state of the industry and projects its business outlook for the 2026-2027 period, a time frame that will be decisive for its future trajectory.

Refractory Industry Outlook – The Current State & Sector in Transition

The contemporary refractory landscape is characterized by a complex interplay of challenges and strategic responses. The era of being a simple supplier of “bricks and mortar” is over; today, it’s about providing integrated, high-performance, and intelligent solutions.

Market Consolidation & the Rise of Specialization

The global refractory market remains moderately consolidated, dominated by a handful of international giants like RHI Magnesita (Austria), Vesuvius (UK), Imerys (France), and Shinagawa Refractories (Japan).

These players have grown through a strategy of mergers and acquisitions to achieve global scale, secure raw material supply, and offer a comprehensive product portfolio.

However, beneath this tier exists a vibrant ecosystem of mid-sized and smaller companies competing through deep specialization—focusing on niche applications, specific geographic markets, or advanced technical ceramics.

The current state is one of “co-opetition,” where giants and specialists coexist, each playing to their strengths.

The Raw Material Conundrum – Will it effect the Refractory Industry Outlook?

The industry’s backbone is its raw materials: magnesite, bauxite, graphite, and alumina. The supply chain for these materials is geographically concentrated and politically sensitive.

China’s dominance in magnesite and its fluctuating export policies, alongside environmental crackdowns on mining in key regions, have created significant price volatility and supply insecurity. This has accelerated two key trends:

- Strategic Sourcing and Vertical Integration: Major players are aggressively acquiring mines and forming long-term partnerships to de-risk their supply chains.

- Alternative Raw Material Development: Research into using lower-grade minerals, industrial by-products (like slag), and synthetic raw materials is intensifying to reduce dependency and cost.

The Green Imperative as a Core Driver of the Refractory Business

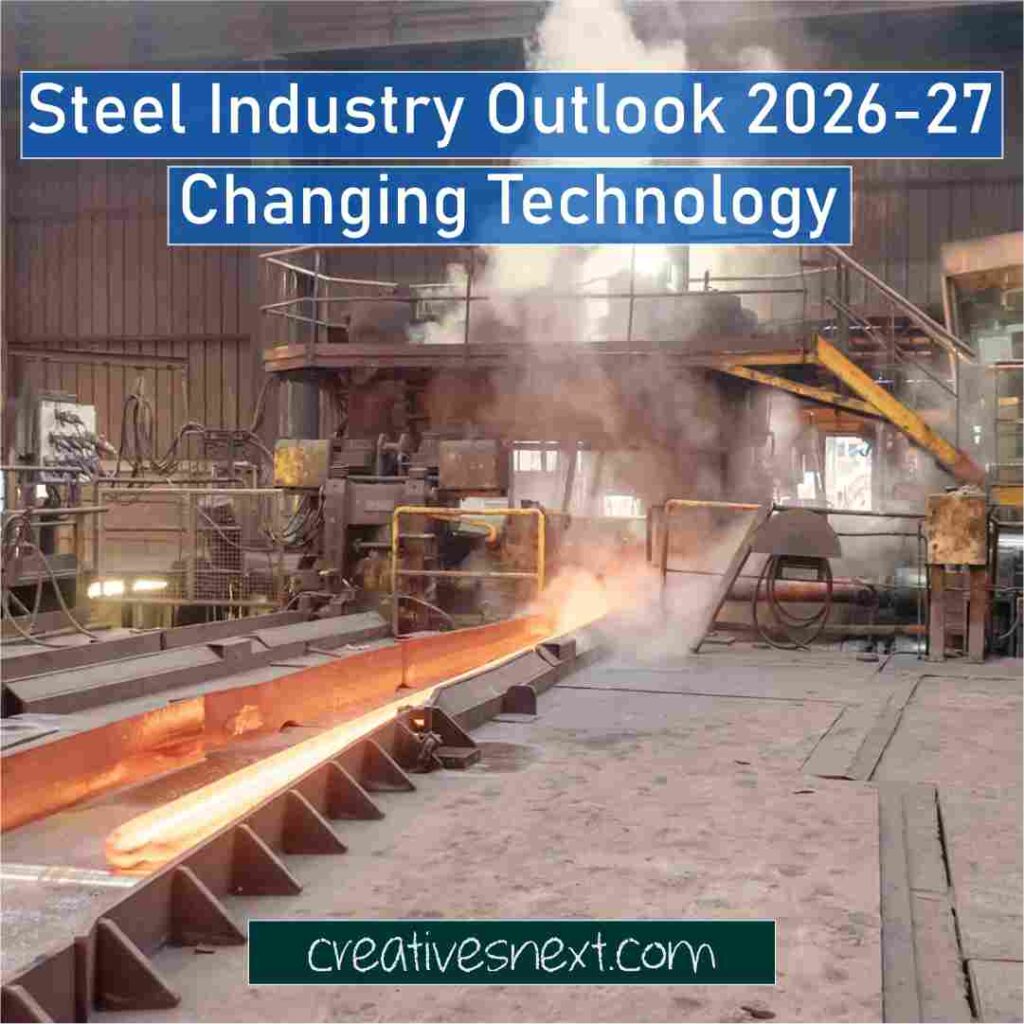

The single most powerful force reshaping the industry is the global push for sustainability. The iron & steel industry, which consumes ~60-70% of all refractories, is under immense pressure to decarbonize.

This directly translates into new demands on refractory producers:

- New Process Technologies in the Global Refractory Industry: The shift from traditional Blast Furnace-Basic Oxygen Furnace (BF-BOF) routes to Electric Arc Furnaces (EAF) and nascent technologies like Hydrogen-Direct Reduced Iron (H-DRI) requires entirely new refractory linings. EAFs demand superior thermal shock resistance, while H-DRI environments pose challenges of hydrogen embrittlement.

- Energy Efficiency: Refractories themselves are being engineered to have lower thermal conductivity, acting as better insulators to reduce heat loss and energy consumption in high-temperature vessels.

- Circular Economy and Recycling: The “take-make-dispose” model is no longer viable. The industry is developing sophisticated methods to collect, process, and re-integrate spent refractories into new products. This “refractory-to-refractory” recycling not only reduces landfill and raw material consumption but also offers significant cost savings.

Technological Evolution of Global Refractory Industry: From Dumb Bricks to Smart Linings

Digitalization and Industry 4.0 are no longer buzzwords but operational realities. Refractory linings are becoming “smarter.”

The integration of embedded sensors allows for real-time monitoring of wear (lining thickness), temperature gradients, and stress points. This data, processed by AI and predictive analytics, enables:

- Predictive Maintenance: Scheduling repairs precisely when needed, avoiding catastrophic failures and unplanned downtime.

- Optimized Campaign Life: Maximizing the operational life of a furnace or kiln, which is a massive contributor to plant profitability.

- Service-Based Models: Companies are increasingly selling “performance” or “uptime” rather than just products, creating long-term, value-added partnerships with their clients.

Refractory Industry Outlook for 2026-2027 – A Cautiously Optimistic Horizon

Looking ahead to 2026-2027, the refractory industry is poised for steady, albeit challenging, growth.

The market, valued at approximately USD 40-45 billion in 2024, is projected to grow at a Compound Annual Growth Rate (CAGR) of 4-5%, potentially reaching USD 48-52 billion by 2027. This growth will not be uniform and will be driven by several key factors.

1. Regional Growth Hotspots and Shifting Demand Patterns

- Asia-Pacific: This region will remain the undisputed growth engine, accounting for over 60% of global demand. India is the standout story, with its massive investments in infrastructure and a rapidly expanding steel industry, making it a battleground for every major refractory player. Southeast Asia (Vietnam, Indonesia) will also see robust growth. China’s demand will mature, shifting from volume to value, focusing on high-quality, environmentally friendly refractories for its upgraded steel and cement sectors.

- North America and Europe: Growth will be more modest but stable, driven by the revitalization of manufacturing (e.g., “onshoring”) and heavy investments in upgrading existing industrial assets for energy efficiency and environmental compliance. The Inflation Reduction Act in the US is expected to stimulate green steel projects, creating new refractory opportunities.

2. Key End-User Industry Dynamics for the International Refractory Business

- Iron & Steel (The Anchor Client): The steel industry’s green transition will be the single biggest driver of R&D and product innovation in refractories. Demand for EAF refractories will surge, while products for traditional BF-BOF will see a slow, structural decline. The period 2026-2027 will see the first commercial-scale demonstrations of H-DRI plants, and the refractory solutions developed for them will be closely watched.

- Non-Ferrous Metals: The energy transition is fueling demand for copper, lithium, nickel, and cobalt. The expansion of smelting and refining capacity for these metals represents a significant and high-value market for specialized refractories resistant to highly corrosive slags and metals.

- Cement and Lime: This sector is focusing on using alternative fuels (like waste-derived fuels), which are often more chemically aggressive than traditional fuels. This necessitates more robust and corrosion-resistant refractory linings.

- Glass and Ceramics: Demand will be linked to the construction and automotive sectors, with a growing need for high-purity refractories for specialty glass used in electronics and solar panels.

3. Strategic Imperatives for Success in the Global Refractory Industry

To thrive in the 2026-2027 landscape, refractory companies must adopt a multi-pronged strategy:

- R&D and Innovation as a Core Competency in the Refractory Industry Outlook: Investment in advanced material science—particularly in monolithic (unshaped) refractories, non-oxide ceramics, and nano-engineered coatings—will be non-negotiable. The winners will be those who can co-develop solutions with their industrial clients.

- Embracing the Service & Solutions Model for the Refractory Companies: The shift from product-selling to service-providing will accelerate. Companies offering installation supervision, robotic gunning, digital monitoring, and life-cycle management will command higher margins and deeper customer loyalty.

- Building Resilient and Sustainable Supply Chains for the Refractory Business: Diversifying raw material sources, investing in recycling infrastructure, and achieving transparency in ESG (Environmental, Social, and Governance) reporting will be critical for securing contracts, especially with large, publicly-traded industrial customers.

- Navigating Geopolitics and Trade for Refractory Companies: Companies must develop agile strategies to manage tariffs, export controls, and regional trade blocs, potentially leading to more localized production hubs.

4. Potential Headwinds and Risks for the Global Refractory Industry

The Refractory Industry outlook is not without its risks.

- Global Economic Slowdown: A protracted recession could dampen investment in core end-user industries like steel and construction, delaying capital projects and squeezing the refractory business margins.

- Prolonged Raw Material Volatility: Further geopolitical instability could disrupt the supply of key raw materials like Chinese magnesite or Ukrainian graphite for the refractory companies, leading to cost spikes.

- Pace of Technological Disruption: If breakthrough green steel technologies (like H-DRI) are adopted faster than anticipated, it could render some traditional refractory product lines obsolete quicker than the industry can adapt.

Conclusion: An Industry Reforged

The refractory industry of 2026-2027 will be almost unrecognizable from that of a decade prior. It is evolving from a cyclical, commodity-linked supplier into a technology-driven, solutions-oriented partner in the global industrial ecosystem.

The path forward is clear: innovate or be left behind. The companies that will lead the charge are those viewing sustainability not as a compliance cost but as the ultimate driver of innovation, those leveraging digital tools to create tangible value, and those building agile, resilient organizations.

The fires of the global industrial furnace are changing—burning cleaner, smarter, and more efficiently. The refractory industry, the very lining that contains and enables this transformation, is itself being reforged in the process, emerging stronger, more sophisticated, and more critical to our industrial future than ever before.

For more Outlook on Manufacturing Industries, click here.