Global Steel Industry Outlook for 2026-27 & the Future Technologies

Published on 17 November 2025

Table of Contents

Introduction

The global steel industry, the bedrock of modern infrastructure and manufacturing, stands at a critical juncture.

Long characterized by its energy intensity and significant carbon footprint, the sector is now undergoing a profound transformation.

Driven by the dual imperatives of decarbonization and digitalization, the latest technological developments are reshaping how steel is made, while a complex global economic landscape defines where it is headed.

As we look towards the 2026-2027 horizon, the industry is poised between legacy challenges and a more efficient, sustainable future.

Let’s look into the upcoming trends that the industry is likely to witness.

Technological Change Reshaping the Global Steel Industry Outlook

The race to produce “green steel” and enhance operational efficiency is fueling unprecedented innovation.

The following technologies are at the forefront of this revolution.

1. The Green Steel Revolution: Decarbonizing the Blast Furnace

The primary goal for major integrated steelmakers is to decarbonize the traditional Blast Furnace-Basic Oxygen Furnace (BF-BOF) route, which accounts for over 70% of global production.

Carbon Capture, Utilization, and Storage (CCUS): Instead of replacing entire plants, companies are investing in capturing CO₂ emissions from blast furnace flue gases. Projects like the HYBRIT initiative in Sweden are leading the way, but the focus for 2026-2027 will be on scaling up CCUS technology to make it economically viable and integrating it into existing infrastructure.

Hydrogen-Based Direct Reduction (H-DRI): This is the most promising pathway for near-zero-carbon steel. By replacing natural gas with “green hydrogen” (produced using renewable electricity) in the Direct Reduced Iron (DRI) process, the only byproduct is water. While large-scale adoption is still a few years away, 2026-2027 will see the commissioning and ramp-up of the first commercial-scale H-DRI plants, setting a new benchmark for the industry.

2. The Rise of the “Smart Mill” in Global Steel Industry: Industry 4.0 in Action

Digitalization is no longer a buzzword but a core operational strategy.

- Artificial Intelligence and Predictive Analytics: AI algorithms are being deployed to optimize every stage of production. From predicting equipment failures (predictive maintenance) to optimizing furnace chemistry and energy consumption in real-time, AI is driving down costs and improving yield.

- Digital Twins: Steel plants are creating virtual replicas of their entire operations. These digital twins allow engineers to simulate process changes, train personnel, and troubleshoot issues without disrupting physical production, leading to faster innovation and reduced downtime.

- Advanced Automation and Robotics: In areas from slab handling to quality inspection, robots equipped with advanced vision systems are improving safety, consistency, and speed. Fully autonomous, lights-out warehouses are becoming a reality for finished steel products.

3. The Electric Arc Furnace (EAF) Evolution as Future Technology

The EAF route, which recycles scrap steel, is inherently less carbon-intensive. Its prominence is growing, and the technology itself is advancing.

- Smart EAFs: AI-powered systems now optimize the melting process by controlling electrode position and energy input based on the scrap mix, significantly reducing electricity consumption.

- Flexible Inputs and Quality Enhancement: New EAF technologies are improving the ability to use lower-grade scrap and alternative iron sources without compromising the quality of the final product, making circular economy models more robust.

Global Steel Industry and Business Outlook for 2026-2027

The global steel industry’s business landscape is fracturing.

No longer driven by a single, global growth narrative, it is becoming a mosaic of regional strategies, influenced by local policies, economic maturation, and geopolitical rivalries.

The outlook for 2026-2027 is best understood by examining the divergent paths with a greater detail.

1. Demand Dynamics: A Tale of Three Continents (and Beyond) affecting the Global Steel Industry

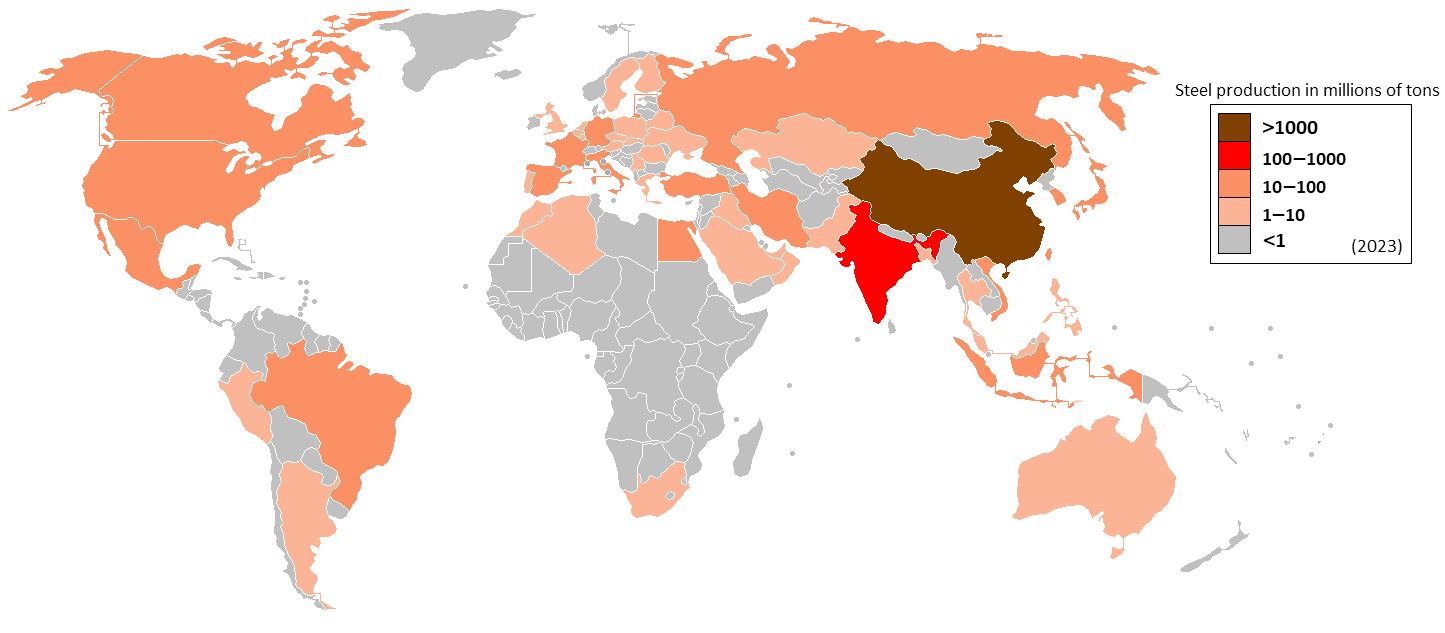

Asia: The End of the Chinese Hegemony and the Rise of the New Titans !

- China’s Structural Shift: The era of China consuming over half the world’s seaborne iron ore and driving global prices is over. Its property sector, which once accounted for a colossal portion of steel demand, is undergoing a fundamental correction. The government’s “Common Prosperity” policy and strategic focus are shifting investment away from speculative real estate and towards high-tech manufacturing, green infrastructure, and advanced technologies.

- Impact on Steel: This means demand will shift from bulk construction-grade rebar to higher-value, flat products like advanced automotive steel (for EVs), specialized plates for wind turbines, and stainless steel for consumer electronics. China will remain the world’s largest producer, but its growth and export patterns will change, focusing more on value-added products and creating opportunities for imports of certain high-grade specialties it does not produce efficiently.

- India: The Next Steel Behemoth: India is poised to become the central story of global steel demand growth. The government’s relentless push for infrastructure (National Infrastructure Pipeline, PM Gati Shakti), urbanization, and manufacturing (Production Linked Incentive schemes) is creating an insatiable appetite for steel.

- Key Drivers: Massive investments in roads, railways, ports, and renewable energy projects (solar parks, wind farms) are direct drivers. The “Make in India” initiative is boosting domestic manufacturing, requiring new industrial facilities and capital goods. By 2026-2027, India is likely to surpass China as the world’s most populous country with a significantly younger demographic, underpinning long-term demand for housing and consumer durables.

- Southeast Asia: The Strategic Hub: Nations like Vietnam, Indonesia, Thailand, and the Philippines continue their rapid industrial growth. They are primary beneficiaries of the “China+1” supply chain diversification strategy pursued by multinational corporations.

- Demand Profile: Steel demand here is fueled by foreign direct investment in new manufacturing plants (e.g., for electronics, automobiles), associated urban infrastructure, and a growing middle class. This region will see strong growth in both long products (for construction) and flat products (for manufacturing).

Africa: The Final Frontier with High Risk and Higher Reward will effect the Global Steel Industry Outlook

Africa’s steel story is one of immense potential constrained by significant challenges. The outlook for 2026-2027 is for gradual, rather than explosive, growth, with hotspots of activity.

- The Infrastructure Deficit as an Opportunity: The continent has a massive infrastructure gap, from energy and transport to housing. This represents a latent demand of hundreds of millions of tonnes of steel. As international partnerships (like the Belt and Road Initiative and the EU’s Global Gateway) and domestic resources are mobilized, this demand will begin to materialize.

- Regional Hotspots of the Global Steel Industry:

- North Africa: Egypt, with its mega-projects (New Administrative Capital, El Alamein City), is a steady consumer. Algeria and Morocco are also significant markets.

- West Africa: Nigeria, despite economic volatility, has a huge need for housing and infrastructure. Ghana and Côte d’Ivoire are more stable growth markets.

- East Africa: Ethiopia was a rising star pre-conflict, and Kenya remains a key hub.

- Southern Africa: South Africa possesses the continent’s most mature steel industry but is hamstrung by energy crises (load-shedding) and logistical bottlenecks at its ports and railways. A resolution to these issues could unleash significant pent-up capacity and demand.

- The Key Challenge before the Global Steel Industry: The primary constraint is not demand but funding and execution. Most projects require international financing. The business environment is characterized by currency volatility, political instability in some regions, and underdeveloped logistical networks. Success will depend on localized strategies and long-term partnerships rather than pure commodity trading.

2. Geopolitical Tensions: Reshaping the Trading Landscape & Global Steel Industry Outlook

The era of hyper-globalization is receding, giving way to a period of strategic competition and managed trade. This has profound implications for steel.

- The Green Trade War is affecting the Global Steel Industry: CBAM and its Progeny

The EU’s Carbon Border Adjustment Mechanism (CBAM) is the most significant trade policy development for the industry in decades. By 2026-2027, it will be fully operational.- How it Works: EU importers will have to buy certificates corresponding to the carbon emissions embedded in their steel imports. This negates the cost advantage of steel produced with a high carbon footprint (e.g., from coal-heavy grids in China, India, or Russia).

- Global Ripple Effects: This will force exporting nations to either:

- Decarbonize their production to remain competitive in the EU market.

- Divert trade to other, less regulated markets, potentially depressing prices in those regions.

- Face retaliatory measures. Other blocs, including the UK and Canada, are considering similar mechanisms, potentially leading to a complex web of green trade rules.

- Strategic Decoupling and “Friend-Shoring”

The US-China rivalry and the fallout from the war in Ukraine have made “supply chain resilience” a top priority for Western nations.- US Policy: The Inflation Reduction Act (IRA) provides massive subsidies for clean energy and EVs, but with strong “local content” requirements. This incentivizes the creation of a full domestic (or allied-nation) supply chain for green steel, batteries, and vehicles, explicitly excluding “foreign entities of concern” (e.g., China).

- Impact on Trade: This policy actively discourages sourcing steel and raw materials from geopolitical adversaries. It accelerates the trend of creating a “Western Hemisphere” steel sphere (involving the US, Canada, Mexico, and EU allies) and an “Asian” sphere centered on China. Countries like India, Brazil, and ASEAN nations will have to navigate this bifurcation carefully.

- The Role of Raw Materials Security

Geopolitics is also playing out in the scramble for key raw materials necessary for both traditional and green steel.- Iron Ore: The dominance of Australia and Brazil in the seaborne market is well-established, but new projects in Africa (Guinea’s Simandou) are becoming strategically vital due to their scale and high-grade ore.

- Critical Minerals: For the green transition, access to minerals for high-strength alloys and batteries (e.g., nickel, chromium, manganese) is crucial. China’s early investments in Indonesian nickel, for instance, have given it a significant advantage in stainless steel production, a point of strategic concern for other nations.

Conclusion

Synthesis of the Global steel Industry Outlook: The New World Order for Steel

By 2026-2027, the global steel industry and the changing technologies will be characterized by:

- Regionalization over Globalization: Trade flows will be shorter, dictated by trade blocs and green alliances rather than pure cost optimization.

- The Green Divide: A clear price and market differentiation will exist between high-carbon “brown steel” and certified low-carbon “green steel,” with the latter becoming the standard for supplying developed economies.

- Strategic Maneuvering: Companies and countries will not just be competing on cost and quality, but on the geopolitical alignment of their supply chains, their access to green financing, and their ability to navigate the new complex web of environmental tariffs and subsidies.

In this new landscape, success will belong to those who are not only efficient producers but also astute geopolitical analysts and agile participants in the emerging green industrial ecosystem.

For more Industry Outlook, click here. This is a human crafted content, assisted by AI.